When running an online business, choosing the right payment gateway directly impacts your bottom line. It affects everything from customer checkout experience to your operational efficiency. With digital payment volumes growing rapidly and countless options available, making the best choice can feel overwhelming.

This guide compares two industry leaders – Stripe and PayPal – helping WordPress site owners understand which option best fits their unique needs. We’ll examine fees, features, integration options, and practical considerations to support your decision-making process.

Understanding Payment Gateways and Their Importance

Payment gateways serve as crucial middleware between your website and financial institutions. They securely process card details, verify funds, and facilitate transfers to your business account. A reliable gateway ensures smooth transactions while maintaining strict security standards.

For WordPress sites, especially those running WooCommerce, your gateway choice affects more than just payment processing. It impacts user experience, conversion rates, and even operational workload. The digital payment gateway market highlights this importance, projected to grow from $106.2B in 2024 to $205.9B by 2030, reflecting an 11.5% CAGR. (Source: 6sense)

This growth reflects changing consumer behavior, with 9 out of 10 consumers now using digital payments and mobile POS transactions forecasted to reach $12.56 trillion by 2025. (Source: Statista)

With such significant market activity, understanding the differences between leading providers like Stripe and PayPal becomes essential for making an informed business decision.

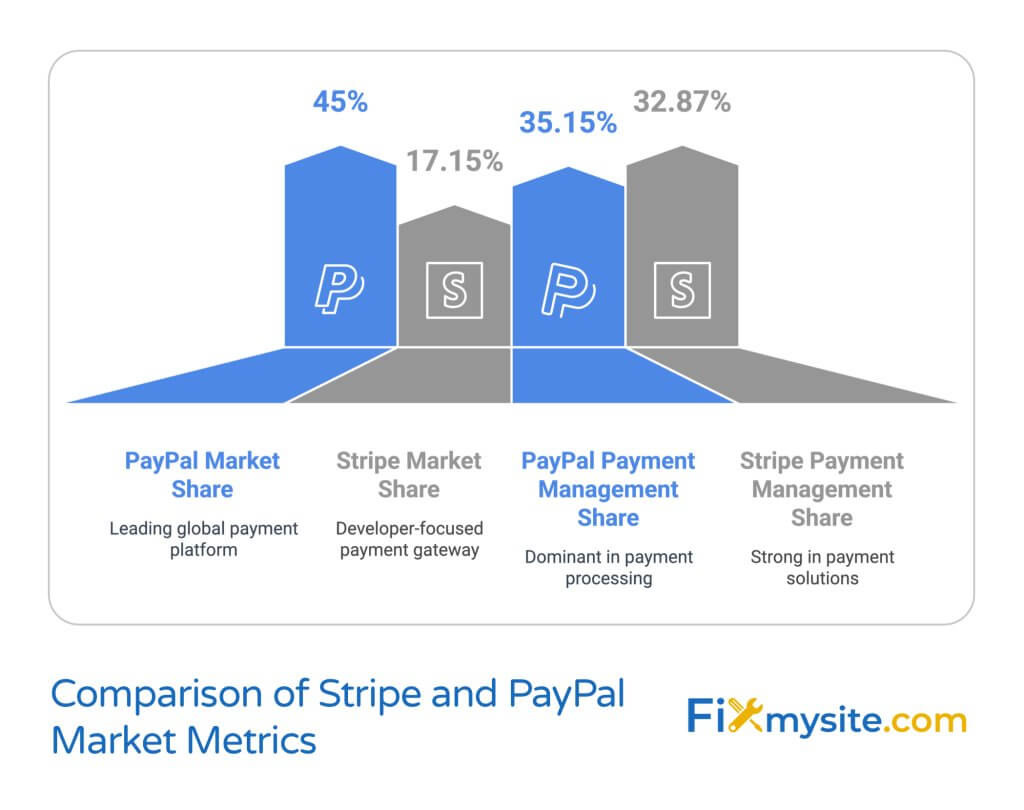

Market Position: Stripe vs PayPal at a Glance

Before diving into specific features, let’s examine how these two payment giants position in the current market. This provides important context for understanding their respective strengths and approaches.

The following table shows their current market standing and adoption rates:

| Metric | PayPal | Stripe |

|---|---|---|

| Global Market Share | 45% | 17-17.15% |

| Payment Management Category Share | 35.15% | 32.87% |

| Year Founded | 1998 | 2010 |

| Primary Focus | Consumer-friendly payments | Developer-first platform |

PayPal dominates approximately 45% of the global payment gateway market, benefiting from its early market entry and strong consumer recognition. (Source: Chargeflow)

In contrast, Stripe, despite being newer, has captured a significant 17-17.15% market share by focusing on developer-friendly tools and customization options. (Source: 6sense)

Both platforms show strong positioning within the payment management category specifically, with PayPal at 35.15% and Stripe closely following at 32.87%. (Source: 6sense)

This market data demonstrates that while PayPal maintains overall dominance, Stripe continues gaining ground, particularly among developer-focused businesses seeking customization.

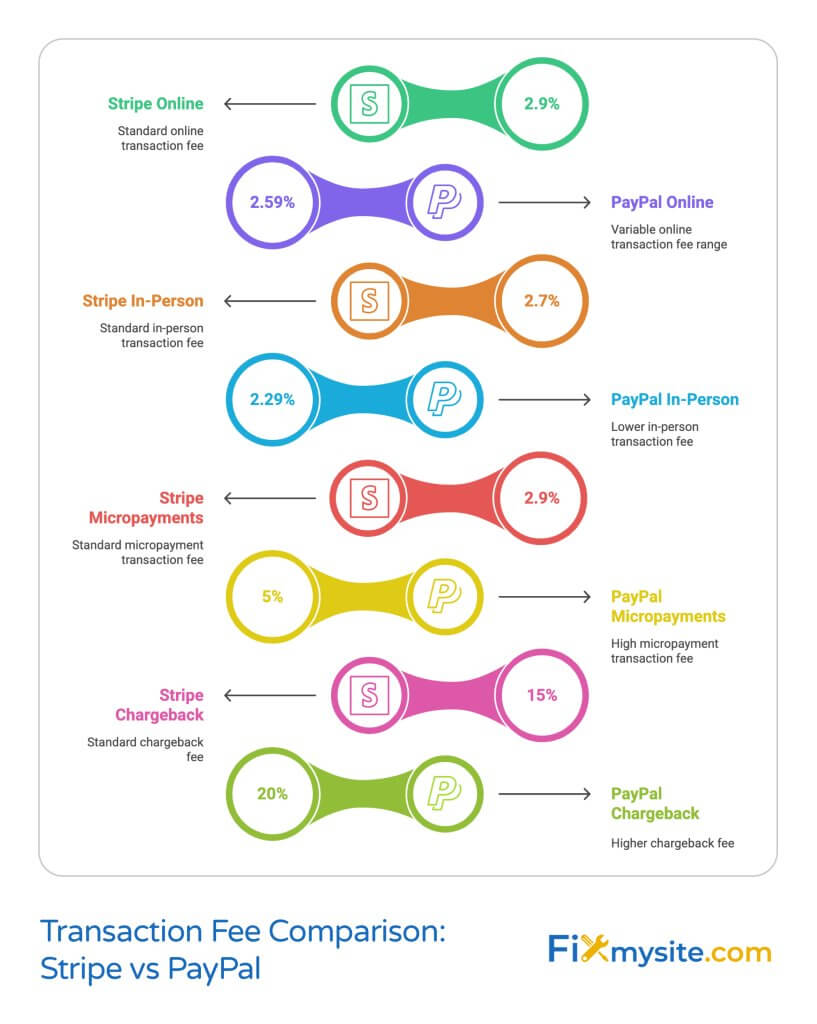

Fee Structure Comparison

Among the most important considerations when selecting a payment gateway are the costs associated with processing transactions. Let’s break down the fee structures for both platforms.

Standard Transaction Fees

The following table outlines the standard transaction fees for both platforms across different payment scenarios:

| Transaction Type | Stripe | PayPal |

|---|---|---|

| Online Transactions | 2.9% + $0.30 | 2.59%-3.49% + $0.49 |

| In-Person Payments | 2.7% + $0.05 | 2.29% + $0.09 |

| Micropayments | 2.9% + $0.30 | 5% + $0.05 |

| Chargebacks | $15 | $20 |

As shown above, Stripe generally offers simpler, more straightforward pricing with a flat 2.9% + $0.30 for online transactions. (Source: Triden Technology)

PayPal’s variable rate structure (2.59%-3.49% + $0.49) can sometimes offer better rates but may make cost forecasting more challenging. For physical retail locations, PayPal provides a slight advantage with lower in-person rates (2.29% + $0.09 vs. Stripe’s 2.7% + $0.05). (Source: Kinsta)

For businesses handling numerous small transactions, PayPal’s micropayment structure (5% + $0.05) may be more economical than Stripe’s standard rate for very small purchase amounts.

International Payment Considerations

For businesses operating globally, international payment capabilities and associated fees become crucial factors. Here’s how the two platforms compare:

| International Aspect | Stripe | PayPal |

|---|---|---|

| Cross-Border Fee | 1.5% | 1.5% |

| Currency Conversion | 1% | 3-4% |

| Currencies Supported | 135 | 25 |

| Countries Available | 39 | 200+ |

Stripe supports an impressive 135 currencies across 39 countries, making it flexible for businesses targeting specific currency markets. (Source: ChargeStripe)

PayPal offers broader geographical coverage, available in over 200 countries, but supports only 25 currencies, which may present limitations for some international business models. The platform also charges higher currency conversion fees (3-4%) compared to Stripe’s more modest 1%. (Source: CheckoutPage)

These fee differences highlight why many globally-focused businesses with higher transaction volumes often favor Stripe, while businesses needing maximum geographical coverage might prefer PayPal despite higher conversion costs.

Global Reach and Availability

For WordPress site owners serving international customers, understanding each platform’s global capabilities is essential. Let’s explore how Stripe and PayPal compare in terms of international reach.

PayPal delivers unmatched geographical coverage, operating in more than 200 countries and regions worldwide. This extensive reach makes it particularly valuable for businesses serving customers across diverse markets, especially in regions where Stripe hasn’t yet established operations.

However, PayPal’s currency support is more limited, handling only 25 currencies. This means transactions in unsupported currencies require conversion, potentially incurring those higher conversion fees mentioned earlier.

In contrast, Stripe operates in fewer countries (39) but supports 135 currencies. This makes it particularly strong for businesses targeting specific currency markets within its supported regions. Stripe generally excels in North America, Western Europe, and developed Asian markets, with continued expansion efforts.

For WordPress site owners, this geographical consideration directly impacts your ability to serve specific markets. If your target audience spans multiple countries, especially in developing regions, PayPal’s broader availability may be crucial. Conversely, if you operate primarily in major markets and need support for specific currencies, Stripe’s capabilities might better serve your needs.

Features and Capabilities

Beyond basic payment processing, both gateways offer diverse features that can enhance your WordPress site’s functionality. Understanding these capabilities helps determine which platform better aligns with your business needs.

Payment Methods Supported

Modern consumers expect flexible payment options beyond traditional credit cards. Here’s how Stripe and PayPal compare in payment method support:

| Payment Method | Stripe | PayPal |

|---|---|---|

| Credit/Debit Cards | Yes (All major cards) | Yes (All major cards) |

| Digital Wallets | 100+ (Apple Pay, Google Pay, etc.) | Limited (PayPal, Venmo) |

| Bank Transfers/ACH | Yes | Yes |

| Buy Now, Pay Later | Limited options | PayPal Credit, Pay in 4 |

| Cryptocurrency | Yes | No |

| International Methods | Extensive | Limited |

Stripe offers broader support for varied payment methods, especially digital wallets and international payment options. This flexibility helps businesses optimize for local preferences across different markets. The platform also recently added cryptocurrency support, appealing to businesses wanting to accept digital currencies.

PayPal focuses more on its own ecosystem, with strong integration of PayPal-owned services like Venmo and PayPal Credit. Their “Pay in 4” option gives customers flexible payment plans, potentially boosting conversion rates for higher-priced products on your WordPress site.

Developer Tools and Customization

The technical aspects of payment integration can significantly impact your implementation experience and ongoing management:

| Technical Aspect | Stripe | PayPal |

|---|---|---|

| API Flexibility | Comprehensive | Basic |

| Documentation | Extensive developer resources | Limited technical documentation |

| Customization | High (fully customizable checkout) | Limited (primarily pre-built solutions) |

| WordPress Plugins | 610+ integrations | Numerous pre-built solutions |

| Technical Support | Developer-focused | General business support |

| Fraud Protection | Stripe Radar (AI-based) | Basic fraud screening |

Stripe provides exceptional developer tools, offering a highly flexible API that allows complete customization of the payment experience. This makes it particularly valuable for WordPress sites needing specific payment workflows or unique checkout experiences.

Stripe’s approach requires more technical knowledge but enables deeper integration with your WordPress systems. With over 610 integrations, even non-technical users can implement basic Stripe functionality, though advanced customization still benefits from development expertise. (Source: ElectroIQ)

PayPal prioritizes simplicity with ready-to-use solutions that require minimal technical knowledge. Their approach favors quick implementation over deep customization, making it accessible for WordPress site owners without development resources. The platform offers several turnkey solutions for WordPress and WooCommerce that can be implemented with basic technical skills.

This difference in approach represents one of the most significant distinctions between the platforms: Stripe favors flexibility and customization, while PayPal emphasizes ease of use and quick deployment.

Integration with WordPress

For WordPress site owners specifically, understanding the integration experience with each platform is essential. Both Stripe and PayPal offer WordPress-compatible solutions, but their implementation approaches differ significantly.

PayPal provides the simplest WordPress integration path with minimal technical requirements. Their official WordPress plugins enable basic payment functionality within minutes, requiring little more than account credentials. This plug-and-play approach works well for small businesses, bloggers, and those following a standard WordPress setup checklist with standard payment needs.

WooCommerce users particularly benefit from PayPal’s straightforward integration. The platform comes pre-integrated with WooCommerce, allowing for immediate activation without additional extensions. This seamless experience makes PayPal an excellent choice for WordPress sites prioritizing quick implementation.

Stripe offers more robust WordPress integration options but typically requires more configuration. While numerous plugins exist to simplify implementation, achieving the platform’s full benefits often involves some customization. For WordPress sites with specific payment requirements or unique checkout flows, this additional complexity delivers valuable flexibility.

For WooCommerce stores handling large transaction volumes, Stripe’s superior handling of high-volume processing can provide significant performance advantages when properly optimized. This can become especially important as your store grows and transaction speeds affect conversion rates.

When choosing between these platforms for your WordPress site, consider both your current technical capabilities and future needs. PayPal offers the faster initial setup, while Stripe provides greater long-term flexibility as your business evolves.

Security and Compliance Features

Payment security remains a critical concern for all online businesses. Both Stripe and PayPal offer robust security features, though their implementation approaches differ in notable ways.

Both platforms maintain full PCI DSS compliance, the industry standard for payment security. This compliance means they meet strict requirements for securing cardholder data, reducing your WordPress site’s security burden substantially. Neither platform exposes raw card data to your servers, minimizing your compliance requirements.

Stripe’s security approach centers around Stripe Radar, their advanced fraud detection system that leverages machine learning to identify suspicious transactions. This system adapts to your business’s specific patterns, potentially reducing false positives that might reject legitimate transactions. For WordPress site owners, this can mean fewer lost sales while maintaining strong protection.

PayPal emphasizes consumer protection programs that can influence buyer confidence. Their familiar checkout process and buyer protection policies may increase customer trust, particularly for new or smaller WordPress businesses without established brand recognition. However, these same buyer protections sometimes favor customers in disputes, potentially increasing the risk of chargebacks for merchants.

For WordPress site owners concerned about security, both platforms provide solid protection when properly implemented. The choice often comes down to whether you prefer Stripe’s more sophisticated fraud detection or PayPal’s consumer-facing trust advantages. Implementing strong WordPress security best practices alongside either payment system creates the most comprehensive protection.

Choosing the Right Payment Gateway for Your Business

With all these factors in mind, how do you determine which platform best fits your specific WordPress business? Let’s break down scenarios where each gateway might be the optimal choice.

When to Choose Stripe

Stripe typically works best for these business scenarios:

| Business Type | Why Stripe Works Well |

|---|---|

| High-volume online stores | More economical for larger transaction volumes |

| Subscription-based businesses | Superior recurring payment handling |

| International focus (major markets) | Better multi-currency support, lower conversion fees |

| Custom checkout requirements | Advanced API allows complete customization |

| Developer resources available | Can leverage full platform capabilities |

Consider Stripe if your WordPress business:

- Processes a high volume of transactions where small fee differences multiply

- Needs extensive customization of the checkout experience

- Operates primarily in Stripe’s supported countries with specific currency requirements

- Has access to development resources for implementation

- Wants to minimize transaction costs as you scale

Stripe particularly shines for growing WooCommerce stores that need fast, reliable payment processing to maintain optimal site performance. Its efficient API and customization options allow for streamlined checkout experiences that can reduce cart abandonment.

When to Choose PayPal

PayPal offers advantages in these specific scenarios:

| Business Type | Why PayPal Works Well |

|---|---|

| New/small businesses | Instant brand recognition and consumer trust |

| Global reach (including developing markets) | Available in 200+ countries |

| Limited technical resources | Simpler implementation, less maintenance |

| Physical retail components | Lower in-person transaction rates |

| Need for fast implementation | Quick setup with minimal configuration |

Consider PayPal if your WordPress business:

- Needs immediate consumer trust and recognition

- Serves customers in regions where Stripe isn’t available

- Has limited technical resources for implementation

- Requires both online and in-person payment solutions

- Prioritizes simplicity over customization

PayPal performs particularly well for newer WordPress businesses where customer trust in the payment process might otherwise be a conversion barrier. The familiar checkout experience can reduce purchase anxiety for first-time buyers.

Implementation Best Practices

Regardless of which platform you choose, following these implementation best practices will help ensure a smooth integration with your WordPress site:

- Always test transactions thoroughly before going live

- Implement proper error handling to manage failed payments gracefully

- Consider mobile responsiveness of your checkout process

- Review and optimize checkout page load speeds

- Set up proper webhook handling for transaction notifications

For WordPress users specifically, pay special attention to plugin compatibility. Some payment gateway plugins may conflict with other WordPress plugins, particularly those affecting checkout processes or form submissions. Testing in a staging environment before deploying to your live site can prevent unexpected issues.

Also consider how your chosen payment gateway integrates with other business systems. Both Stripe and PayPal offer extensive integration capabilities with accounting software, CRM systems, and other business tools. Planning these connections during implementation can save significant time later.

Conclusion

Choosing between Stripe and PayPal for your WordPress business ultimately depends on your specific needs, technical capabilities, and growth plans. PayPal offers superior ease of use, broader global reach, and instant brand recognition that can boost customer confidence. Stripe delivers greater customization, potentially lower fees at scale, and more sophisticated developer tools.

Many successful WordPress businesses actually implement both platforms, offering customers their preferred payment method while leveraging each system’s strengths. This hybrid approach maximizes conversion potential but requires maintaining two systems.

Remember that your payment gateway is a critical component of your WordPress site’s infrastructure. If you’re struggling with integration issues or need help optimizing your payment system, our WordPress support team can provide expert assistance tailored to your specific needs.

By carefully considering the factors outlined in this comparison and aligning them with your business requirements, you’ll be well-positioned to select the payment gateway that best supports your WordPress business goals.